What Makes College Towns Attractive for Real Estate Investment

College towns represent a unique opportunity for real estate investors due to their consistent rental demand, robust economies, and vibrant community lifestyles. These factors collectively ensure long-term stability and growth potential.

Steady Rental Demand

A constant influx of students ensures a reliable pool of renters. In addition to students, faculty, staff, and visiting researchers contribute to year-round occupancy rates. Properties near campuses or public transit hubs typically experience higher demand and premium rents.

Strong Economy and Infrastructure

Colleges and universities anchor local economies, attracting businesses like bookstores, cafes, and tech incubators. Public investments in transportation, utilities, and healthcare facilities often follow, further bolstering property values. These areas tend to have unemployment rates lower than national averages.

Community and Lifestyle Appeal

College towns foster diverse, progressive communities that attract professionals, families, and retirees. Cultural events, athletic programs, and entrepreneurial opportunities create an appealing atmosphere for both renters and homeowners. Properties near amenities like parks or entertainment venues often see higher appreciation rates.

Top College Towns That Are Real Estate Goldmines

College towns combine strong rental demand, economic growth, and diverse amenities, creating real estate opportunities for investors. Here’s why these specific towns stand out as ideal investments.

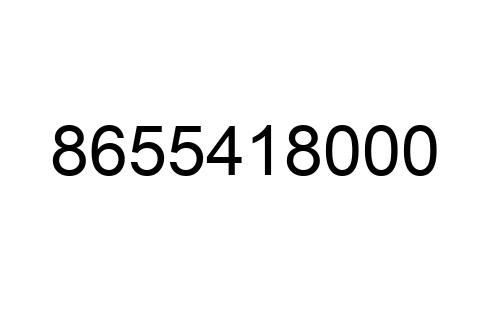

Austin, Texas

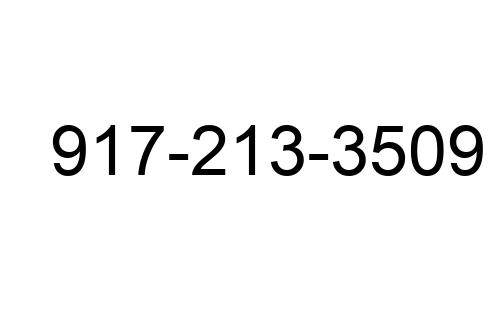

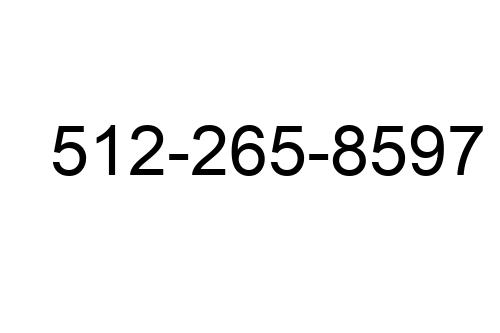

Austin, home to the University of Texas, offers a booming housing market fueled by technology companies and robust job growth. The rental market remains strong year-round due to the city’s growing student population and influx of young professionals. Properties near campus or tech hubs hold high appreciation potential.

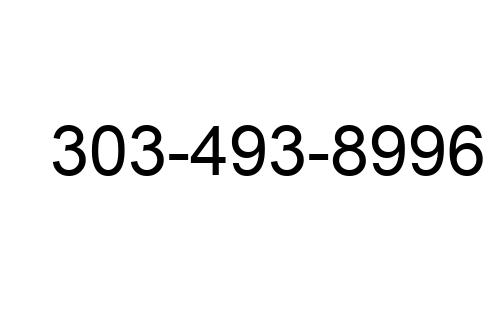

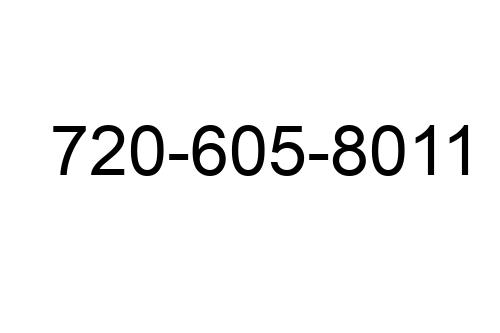

Boulder, Colorado

Boulder benefits from the University of Colorado’s presence and ranks among the most desirable places to live. Limited land availability and eco-friendly regulations drive up property values. Investors often see steady demand for rentals near Pearl Street and the Flatirons due to the city’s active lifestyle and employment opportunities.

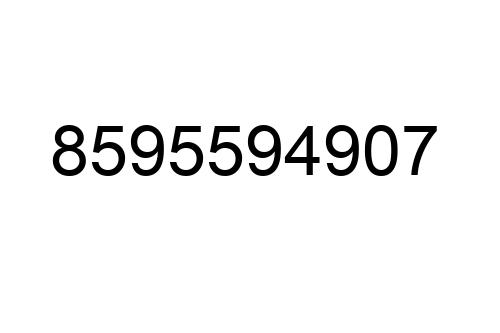

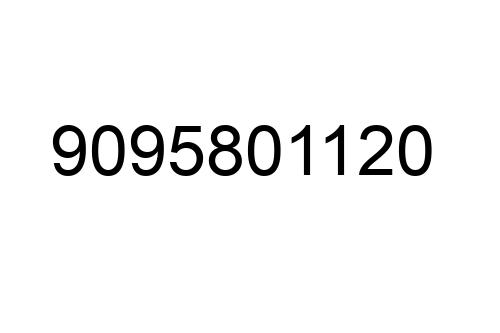

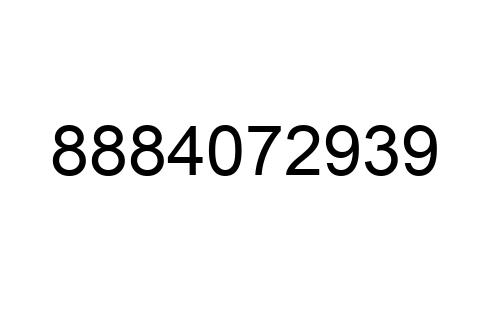

Ann Arbor, Michigan

Ann Arbor’s real estate thrives thanks to the University of Michigan, a significant economic driver. The city’s walkable neighborhoods and top-rated public schools attract long-term renters and buyers. Properties in Kerrytown and the downtown area are especially popular due to proximity to shops, restaurants, and cultural landmarks.

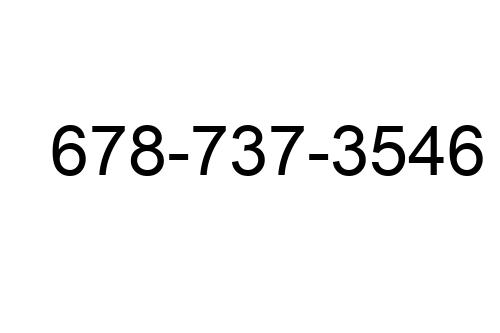

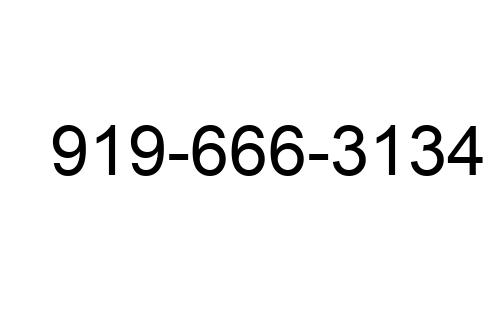

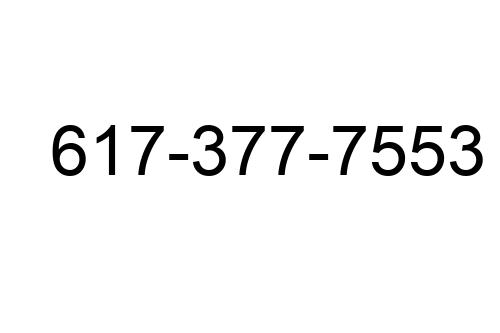

Durham, North Carolina

Durham’s thriving real estate market revolves around Duke University and Research Triangle Park, one of the largest research hubs in the US. The combination of student housing demand and professional relocations ensures competitive occupancy rates. Investment hotspots include areas like Ninth Street and Brightleaf Square, known for vibrant dining and retail scenes.

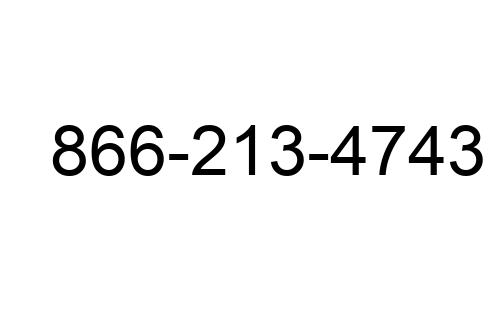

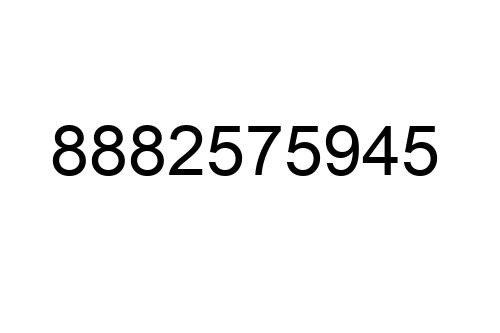

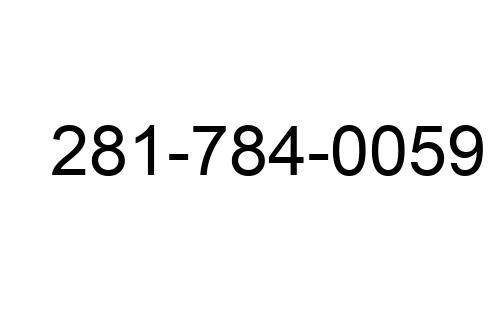

Madison, Wisconsin

Madison benefits from the University of Wisconsin’s influence and a strong local economy. Its dual identity as a college town and state capital guarantees year-round demand for housing. Properties near State Street and the Capitol Square consistently attract renters due to proximity to campus, cultural amenities, and business districts.

Factors to Consider When Investing in College Town Real Estate

Investing in college town real estate offers stable rental demand and long-term appreciation potential. Careful evaluation of key factors can maximize returns and minimize risks.

Local Market Trends

Monitoring local market trends helps identify profitable investment opportunities. High occupancy rates, rising rental prices, and steady population growth indicate strong demand. For example, college towns with increasing student enrollment often sustain rental markets. Analyzing housing supply, including new developments, reveals potential competition for tenants.

Proximity to Campus and Amenities

Properties near campuses and amenities attract consistent renters. Locations within walking or biking distance to universities, libraries, and dining options often command higher rents. Proximity to public transportation and healthcare facilities increases appeal for both students and faculty renters.

Long-term Growth Potential

- Evaluating long-term growth potential ensures sustainable value appreciation.

- Towns with university-driven economies and local investments in infrastructure often outperform others.

- Tech partnerships, research parks, or cultural developments enhance the area’s economic stability, boosting property demand and appreciation rates.

Benefits of Investing in College Towns

College towns offer unique advantages for real estate investors. Their active rental markets, low vacancies, and diverse tenant populations create reliable income opportunities.

High Rental Yield

College towns consistently deliver higher rental yields. Demand from students, faculty, and university staff ensures competitive rental rates. For example, properties near large universities like the University of Texas in Austin and the University of Michigan in Ann Arbor command premium prices due to proximity and accessibility. Landlords can set consistent rent increases as student enrollment grows, enhancing profitability.

Low Vacancy Rates

Vacancy rates in college towns remain low year-round. Universities provide a constant influx of renters, even during breaks, with graduate students, visiting professors, and research fellows often filling off-season gaps. In towns like Madison, Wisconsin, where the university population overlaps with local professionals, properties rarely stay vacant.

Diverse Tenant Base

The tenant base in college towns extends beyond students. Faculty members such as:

- administrative staff

- researchers

- visiting professionals also need housing

This variety reduces dependency on any single tenant category, providing stability. Towns such as Boulder, Colorado, attract eco-conscious and tech-driven tenants alongside traditional university renters, expanding investment potential.