Understanding Real Estate Hotspots

Recognizing real estate hotspots is crucial for maximizing returns on property investments. These areas often experience rapid growth and demand due to specific factors.

What Are Real Estate Hotspots?

Real estate hotspots are locations with high investment potential driven by economic, demographic, or infrastructural developments. Cities expanding due to employment growth or suburban areas benefiting from urban spillover are common examples. These hotspots often see rising property values and rental demand, creating ideal conditions for substantial ROI.

Importance of ROI in Real Estate Investments

ROI measures the profitability of a real estate investment, highlighting its effectiveness. Investing in hotspots enhances ROI by capitalizing on factors like increasing populations or planned infrastructural upgrades. For example, a property in an area with new transportation projects may yield faster appreciation or higher rental income than one in a stagnant market.

Key Factors That Define a Real Estate Hotspot

Identifying real estate hotspots involves evaluating specific attributes contributing to high investment potential. These factors drive property value appreciation and generate maximum ROI.

Economic Growth and Job Opportunities

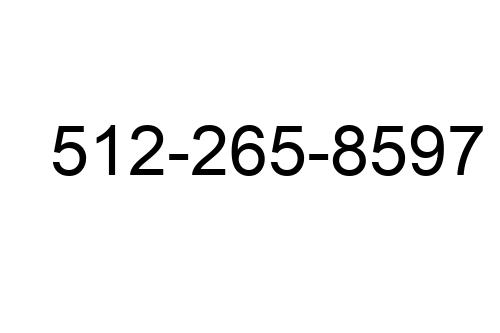

Economic growth directly impacts real estate values by attracting businesses and workers to an area. High-growth regions consistently generate demand for commercial and residential properties. Cities like Austin, Texas, saw rapid property value increases due to strong tech industry expansion. I always examine industries driving job creation since they boost housing demand and rental yields.

Infrastructure Development

Infrastructure projects elevate a location’s desirability by improving living standards and connectivity. Developments like airports, highways, and public transit hubs substantially enhance property values. For instance, areas near new metro rail stations witness faster appreciation. I prioritize spots with planned infrastructure upgrades for long-term ROI potential.

Population Growth and Demand

- Growing populations create sustained demand for housing, fostering price and rent increases.

- Urban centers experiencing migration, such as Denver, Colorado, showcase how population growth raises investment value.

- When evaluating a hotspot, I consider demographic trends, including inflows of young professionals and families, to gauge future demand.

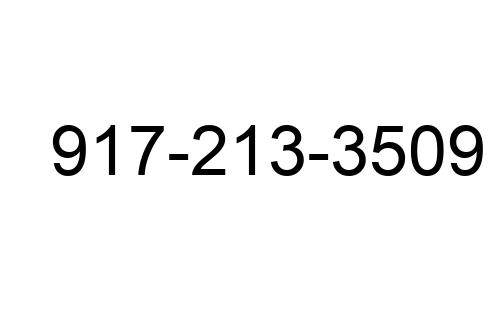

Accessibility and Transportation

Ease of access is vital in defining a property’s appeal. Proximity to roads, transit systems, and major job centers directly impacts value. Neighborhoods near efficient transportation networks, like those around New York City’s PATH system, often outperform others in ROI. I focus on properties offering convenient access to amenities and employment areas.

Top Real Estate Hotspots in 2023

Identifying the right locations is key for maximizing ROI in real estate. This year offers opportunities in emerging markets, reliable established zones, and promising international destinations.

Emerging Markets to Watch

Emerging markets show rapid growth due to factors like urban development and population increases.

- Cities like Nashville, Tennessee, stand out because of strong job markets and a vibrant cultural scene, driving housing demand and property appreciation.

- Raleigh, North Carolina, benefits from tech industry expansion and affordable living costs, making it attractive for both buyers and renters.

- Smaller cities, such as Boise, Idaho, are gaining attention as they combine affordability with increasing migration trends.

Established Markets with Consistent ROI

Established markets offer stability and proven returns. New York City remains a strong option, particularly for luxury apartments in Manhattan neighborhoods like Chelsea or Tribeca, where rental demand is constant. Los Angeles continues to perform well, with areas like Santa Monica and Hollywood offering a mix of residential and commercial investment opportunities. Austin, Texas, is another high-performing market, driven by tech industry growth and continuous population influx, keeping property values steady and demand high.

International Locations Worth Considering

International markets offer diversification and potential for high returns. Lisbon, Portugal, attracts investors due to affordable property prices and booming tourism, supported by programs like the Golden Visa. Dubai, UAE, stands out with tax-free investment benefits and a strong rental market, especially in areas like Downtown Dubai or Palm Jumeirah. Melbourne, Australia, combines a stable economy with high urban migration, making it a prime hotspot for long-term investment.

Tips for Identifying Future Hotspots

Identifying future real estate hotspots requires a strategic approach. I rely on thorough research, data analysis, and insights from industry professionals to determine high-potential investment areas.

Analyzing Market Trends

Tracking market trends unveils patterns that signal emerging hotspots. I review data like property price growth, rental yields, and demand indicators over the past several years. For example, I monitor cities undergoing significant population influx or wage growth, as these factors often drive housing demand. Platforms like Zillow and Realtor.com provide valuable regional data, while state and federal housing reports offer macroeconomic insights.

Leveraging Local Expertise

Local real estate experts provide context that’s often missing from national data sets. I connect with realtors, developers, and property managers familiar with nuanced neighborhood dynamics. For instance, developers might share plans for upcoming infrastructure that will boost value. I also tap into local government announcements regarding zoning changes or transit improvements, which can indicate future demand.

Assessing Long-Term Growth Potential

I evaluate factors indicating sustained growth. Economic catalysts, like new industry hubs or tech headquarters, often predict steady property appreciation. I also examine areas with strong infrastructure projects, like airport expansions and new transit lines, as these create long-term value. Additionally, I assess population projections and urban development plans to identify locations likely to sustain high ROI over the next decade.