Why Coastal Cities Are Prime for Real Estate Investment

Coastal cities offer unique advantages that attract investors. Their strong tourism appeal, driven by beautiful beaches and recreational opportunities, ensures a consistent demand for short-term and long-term rentals. This demand often creates steady income potential for property owners.

Real estate in coastal cities benefits from limited land availability near the coastline. This scarcity increases property value over time, providing significant appreciation opportunities for investors. For example, oceanfront homes in cities such as Miami or San Diego often command premium prices due to this exclusivity.

Economic growth in many coastal cities supports diverse industries, including tourism, trade, and technology. Cities like Seattle and Los Angeles combine proximity to the water with robust job markets, creating opportunities for both residential and commercial real estate investments.

Coastal cities are popular with retirees and second-home buyers. Places like Charleston and Sarasota attract individuals seeking attractive climates, relaxing lifestyles, and quality healthcare. This demographic shift boosts luxury real estate and retirement-friendly housing demand.

Many coastal areas have stringent zoning and environmental regulations. These constraints limit overdevelopment, protecting property value and maintaining the area’s desirability. Properties in regulated areas, like Cape Cod, often retain their charm while offering stable investment performance.

Real estate markets in coastal cities are resilient during economic recovery periods. Their attractive locations and diverse industries make them bounce back quicker after downturns, which sustains long-term investment stability.

Factors to Consider When Investing in Coastal Properties

Understanding key factors ensures informed decisions when investing in coastal real estate. Evaluating economic, environmental, and lifestyle aspects is crucial for maximizing returns and minimizing risks.

Economic Growth and Stability

Regions with stable and growing economies offer strong real estate investment potential. High employment rates and diverse industries support consistent property demand. For instance, cities like San Diego, with thriving biotech and tourism sectors, attract both renters and homeowners. Low unemployment rates and tech hubs in coastal areas like Seattle further boost market reliability. Sustainable growth in these markets reduces risks of market fluctuations.

Climate and Resilience to Natural Disasters

Coastal investments must account for weather conditions and disaster risk. Areas prone to hurricanes, rising sea levels, or flooding may involve higher insurance costs and maintenance expenses. Cities employing effective disaster resilience strategies, like Miami’s infrastructure improvements against flooding, enhance property security. Investing in areas outside high-risk zones mitigates long-term financial risks. Evaluation of historical weather patterns helps assess vulnerability.

Tourism and Lifestyle Appeal

Strong tourism markets increase demand for rental properties in coastal cities. Destinations like Miami Beach, with year-round visitors, generate consistent short-term rental income. Lifestyle appeal, such as walkable beachfronts or vibrant dining scenes, attracts long-term buyers to areas like Charleston, South Carolina. High guest occupancy rates make these features vital for short-term vacation rentals’ profitability. Rich cultural or recreational amenities add further appeal to these markets.

Top Coastal Cities for Real Estate Investments

Investing in coastal cities offers opportunities for strong returns through property appreciation and rental income. Below are some of the top cities combining lifestyle appeal with solid economic fundamentals.

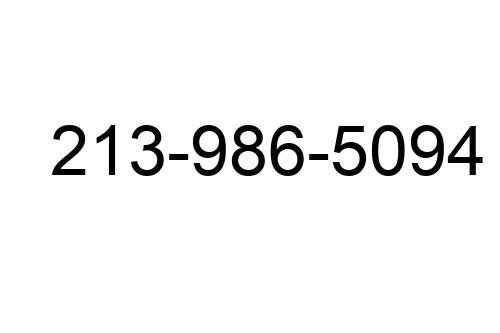

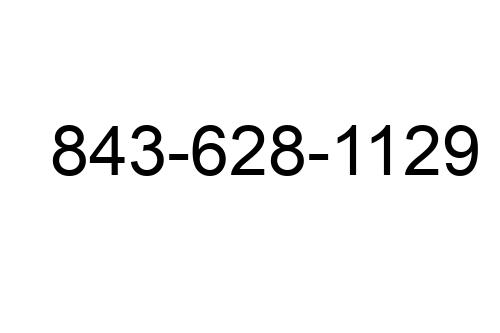

Miami, Florida

Miami provides a dynamic mix of high demand, luxury appeal, and strong rental prospects. Its real estate market benefits from international buyers, driven by the city’s position as a global hub. Miami’s tourism attracts steady rental incomes, especially in areas like South Beach and Brickell. Consistent population growth and no state income tax boost its long-term investment potential.

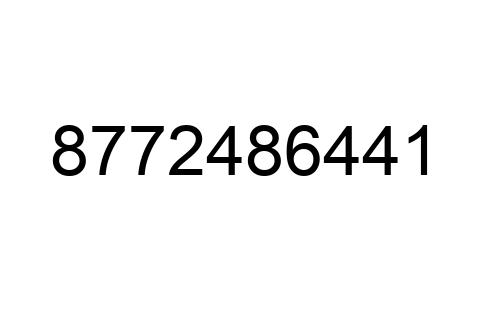

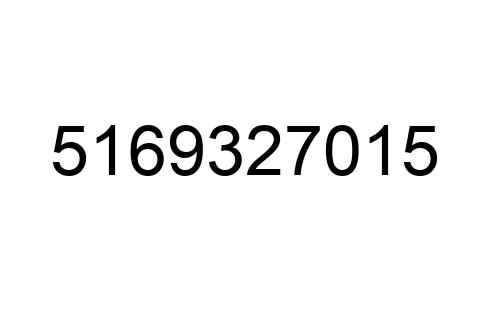

San Diego, California

San Diego’s real estate market thrives on its mild climate, tech industry, and military presence. The city attracts professionals, families, and retirees, sustaining high rental demand. Coastal properties in La Jolla and Pacific Beach offer excellent appreciation opportunities. With limited land for new developments, property values in San Diego remain strong over time.

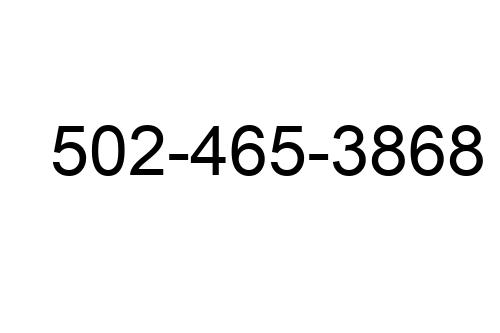

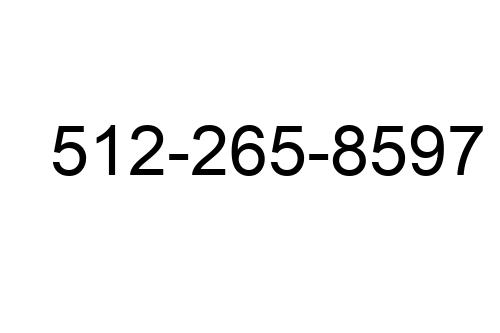

Charleston, South Carolina

Charleston stands out with its historic charm and rising popularity as a tourist destination.

- Its thriving port economy and growing tech sector make it an attractive market for residential investments.

- Areas like Mount Pleasant and Sullivan’s Island command high rental rates.

- Low property taxes and strong demand for vacation homes enhance its market appeal.

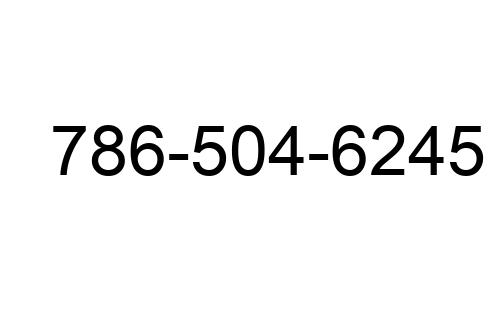

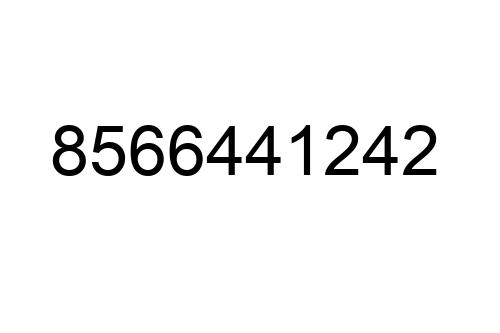

Honolulu, Hawaii

Honolulu combines breathtaking views, high rental demand, and limited real estate supply. As Hawaii’s economic hub, it attracts tourists and investors year-round. Waikiki offers lucrative opportunities for vacation rentals, while neighborhoods like Kahala see consistent price appreciation. Stringent development restrictions contribute to maintaining high property values.

Benefits of Investing in Coastal Real Estate

Coastal real estate offers lucrative opportunities for investors due to its unique market characteristics. Properties in these areas provide financial returns and long-term security for investment portfolios.

High Rental Income Potential

Coastal properties generate strong rental income due to consistent demand from tourists and long-term renters. Locations like Miami and Honolulu, known for their year-round appeal, benefit from steady tourism-driven cash flow. Vacation rentals in these areas often command premium rates, especially during peak season.

Appreciation in Property Value

Limited land and increasing demand drive property appreciation in coastal cities. Over the past decade, cities like San Diego and Charleston have seen annual property value growth rates of 5-7%. Strict zoning laws in many coastal regions also help maintain exclusivity, supporting long-term value retention.

Diversification of Investment Portfolio

Coastal real estate diversifies portfolios, balancing risk across market segments. These properties combine stable appreciation with rental revenue, creating dual income streams. Investing in cities like Seattle, where diverse industries stabilize the economy, minimizes exposure to market volatility while enhancing returns.